Research shows when it comes to life insurance and income protection, the majority of Australians aren’t sufficiently covered.

In fact, it’s been found that fewer than five percent of Australians with dependent children have adequate life insurance cover in place. This is what the experts call ‘underinsurance’ – and it’s a big problem in this country.

So what should you be doing to ensure you’re not underinsured, and exactly how much cover do you need?

These are questions we will answer in this article.

Obtaining adequate life insurance

There will always be differing views around the level of insurance protection that Australians require.

The reality is that the amount you need will depend on how much your dependants will need to cover housing costs, the repayment of debts and funeral costs.

The number of dependants a person has and the age of those dependents will obviously also vary.

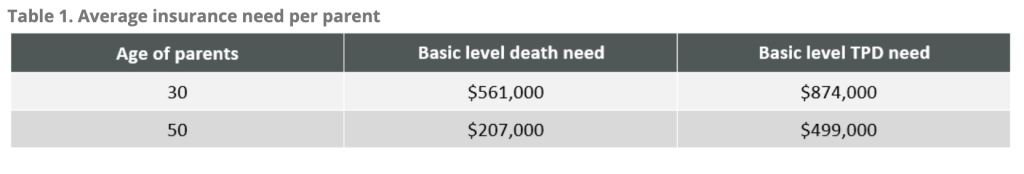

Despite those grey areas, research company Rice Warner has provided a figure for the average ‘basic’ level of cover needed for parents at the age of 30 and at the age of 50.

Those figures (for both death and Total and Permanent Disability (TPD) cover) are shown in this table:

What about income protection insurance?

Nobody plans on becoming sick or injured, but let’s be real, it happens.

What would it cost you, and your family, if you couldn’t work for a sustained period of time?

Income protection ensures your bills, mortgage, debts and regular expenses are covered even if you’re not receiving an income, taking the financial pressure off your recovery and protecting what’s most precious to you.

So exactly how much protection should you have?

Most policies will offer somewhere between 70% and 90% per cent of your income, with the highest rate usually paid during the first six months you’re unable to work.

Working with your financial planner, you should prepare a budget so you can see your monthly expenses and exactly what percentage of your income you’ll need to replace (you’ll need to factor in superannuation payments as well).

Get advice

When it comes to personal risk insurance, everyone has different circumstances to consider.

Heard financial can assess your situation, in line with your obligations and wealth goals, and ensure you have the right level of life insurance, with the best policy for your needs.

We help you get peace of mind against life’s uncertainties and provide financial protection to your loved ones after you’re gone.

For a no obligation discussion about your needs, contact us today.

This information may be regarded as general advice. That is, your personal objectives, needs or financial situations were not taken into account when preparing this information.

Accordingly, you should consider the appropriateness of any general advice we have given you, having regard to your own objectives, financial situation and needs before acting on it. Where the information relates to a particular financial product, you should obtain and consider the relevant product disclosure statement before making any decision to purchase that financial product.